Ready To Raise Capital Or Close Your Next Deal? We Can Support You:

M&A And Fundraising

Advisory

-

Financial modelling

-

Valuation

-

Preparation of marketing package

-

Due diligence

-

Deal structuring

-

Negotiations

-

Finding investors & buyers

-

Finding acquisition targets

Financial Modelling

& Valuation

-

Operational modelling (granular cash flow analysis)

-

Capital and transaction structure modelling (equity & debt)

-

Investment returns analysis

-

Capital ownership table analysis

-

Valuation based on discounted cash flows and market benchmarks

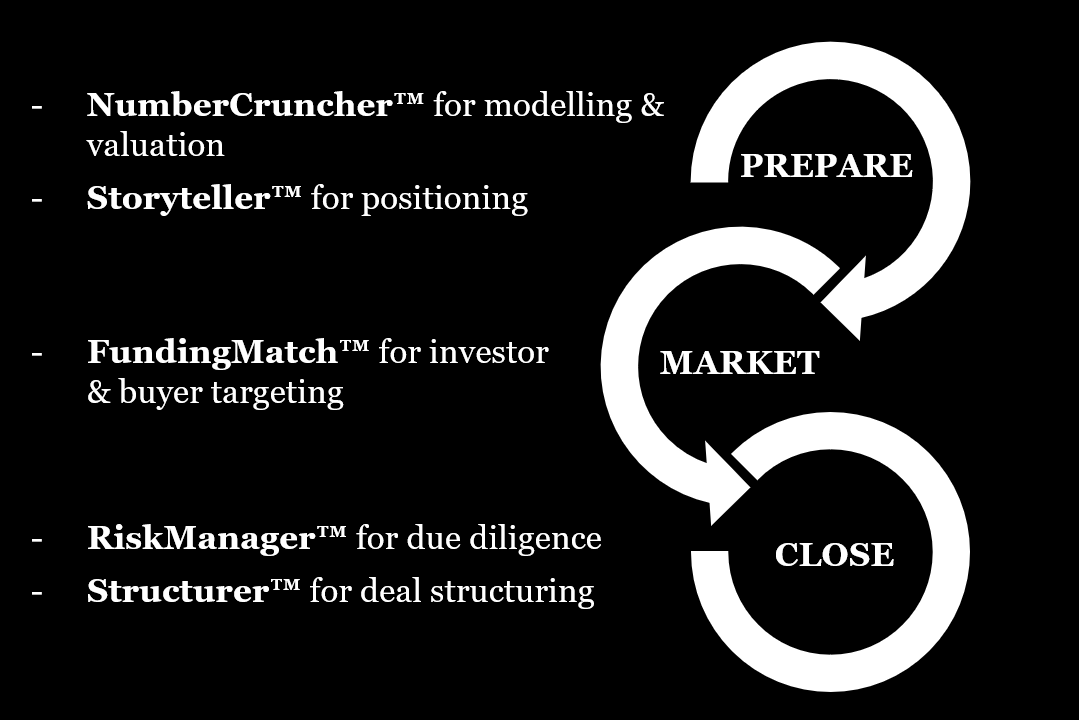

Where AI Meets Investment Banking

AI-powered efficiency

Close deals 50% faster with less stress

Better outcomes

Optimised valuations,

lower execution risk & cost

Proprietary tools

We Focus On Sectors That Drive Progress

We prioritise workflow across the following sectors, in any geography:

-

Energy & natural resources

-

Chemicals & manufacturing

-

Electrification of transport & batteries

-

Recycling

-

Datacentres

-

AI & software

-

Robotisation

-

Healthcare & nutrition

-

Agritech

Who We Are

Michel Besson is the founder of CFC Strategy.

With close to 15 years of global investment banking experience in energy and natural resources across both developed and emerging markets, he has driven over $30bn in M&A, equity, and debt transactions – including multibillion-dollar strategic acquisitions and small-cap growth financings. He advises on complex transactions that accelerate sector transformation.

Michel was most recently a Director at Alexa Capital and before that a Vice President in the Barclays in the Energy & Natural Resources Group.

Michel speaks English, French and Russian. He graduated from Imperial College.

Michel is also the founder of Fine Cigars Club

+447479519684

Working With The Best